There are many formalities that you are required to complete when you’re moving to Canada as a permanent resident (PR). There are documents to prepare and organize, financial matters to be addressed, belongings to be shipped, and much more. One of the important tasks is to have the forms BSF186 and BSF186A ready. These are also popularly known as forms B4 and B4A, respectively.

Forms B4 and B4A are essential documents required for entry into the country (along with your passport, PR visa, and Confirmation of Permanent Residence). They will have to be presented to the officer at your first port of entry in Canada. For some of you, this could be the connecting or layover airport in Canada. In this article, we will walk you through the process of accurately filling out the forms so that you’re well-prepared for your move to Canada.

| Note: Completing these forms prior to arrival is not mandatory but it does help save time after you land in Canada. If you choose to complete the forms at the airport, after arrival, have all essential information ready to go. |

|---|

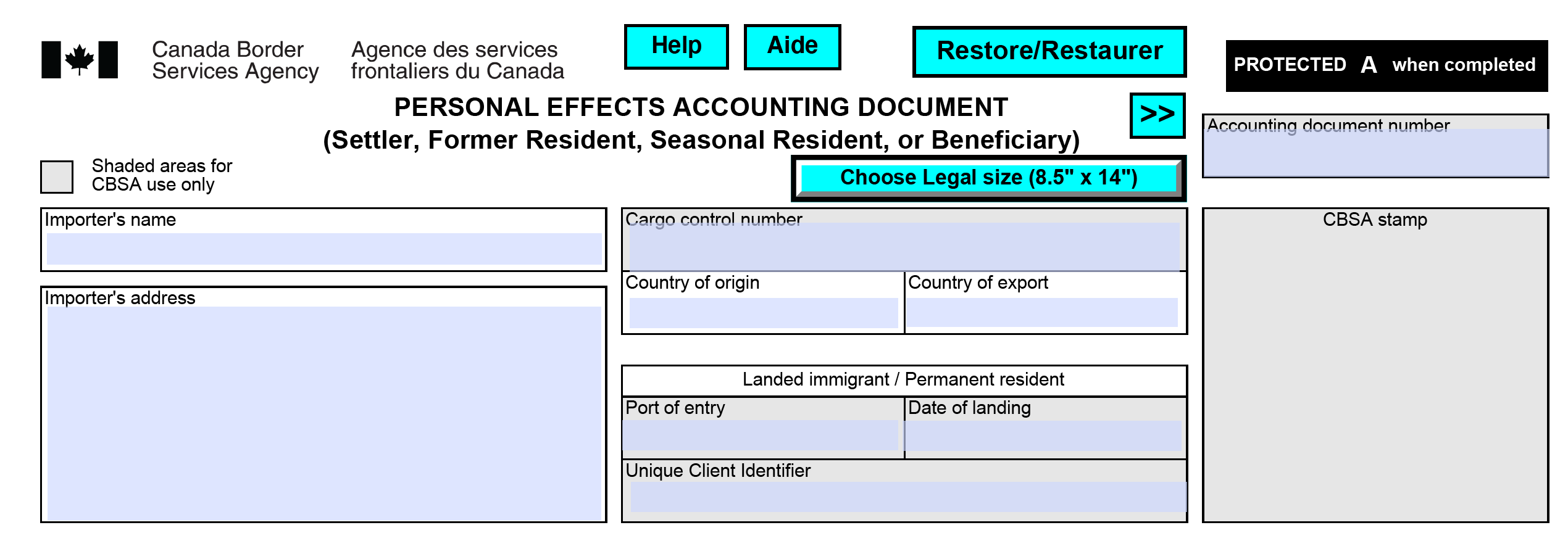

What are the BSF186 forms (B4 and B4A)?

Forms B4 and B4A are personal effects accounting documents, also known as settler’s effects lists. Those moving or returning to Canada with the intention of establishing permanent residence are required to fill these forms.

Form BSF186 (or B4): This is used to outline and keep track of the items you are bringing with you at the time of entry into Canada. Items listed on this form are ones that you owned in your home country and intend on using for your household and personal use in Canada. The list will help border officers determine if you need to pay duty on any of the goods. You can find the exhaustive list of permitted and restricted items on the Canada Border Services Agency (CBSA) website. This form is required even if you have no goods with you at the time of arrival.

Form BSF186A (or B4A): This is a goods-to-follow list and is used to track all the items that will be arriving in Canada separately – either on the day of your arrival or after your arrival. You should fill this form if you’re having any of your belongings shipped. If you don’t complete this form and your goods arrive at a later date, you may have to pay duty for importing them into Canada. One of the major benefits of completing form B4A and getting it stamped by the CBSA offer is that your goods will qualify for duty- and tax-free importation into Canada.

You’ll need to have two copies (one for you and one for the CBSA officer) of both forms. CBSA officials will stamp both copies and assign a file number. They will keep one set of completed forms and return the other to you along with a receipt.

Tip: Ensure you have the B4 and B4A forms on your person or in your carry-on luggage, as they will be required to be presented to the CBSA officer at your first port of entry in Canada.

How to fill form BSF186 (also known as form B4)

Part 1: Personal information

Form B4 has some fields meant for the CBSA officers; these are marked in grey. You can leave the following fields blank:

- Accounting document number

- CBSA stamp

- Cargo control number

- Port of entry

- Date of landing

- Unique Client Identifier (UCI)

Fields that you should fill in this section –

| Field name | Description |

|---|---|

| Importer’s name | Your first name and last name. |

| Importer’s address | Your address in Canada. This could be the same address that you will provide for the delivery of your PR card. |

| Country of origin | Your home country OR the country from where your items/goods are being transported or shipped. |

| Country of export | The country you are exporting to, i.e. Canada. |

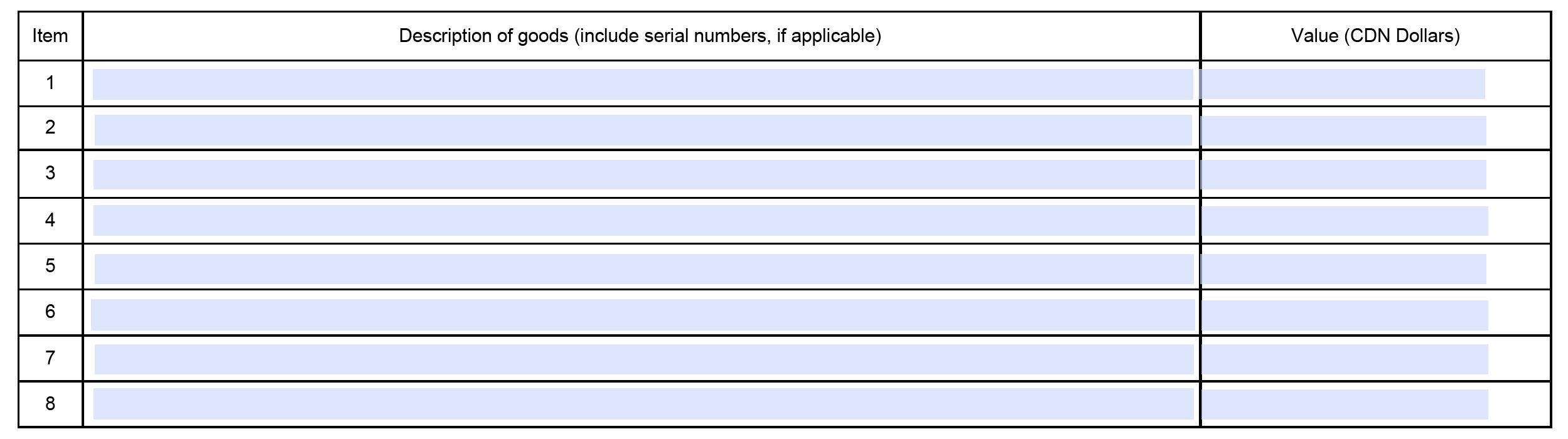

Part 2: Itemized list of goods

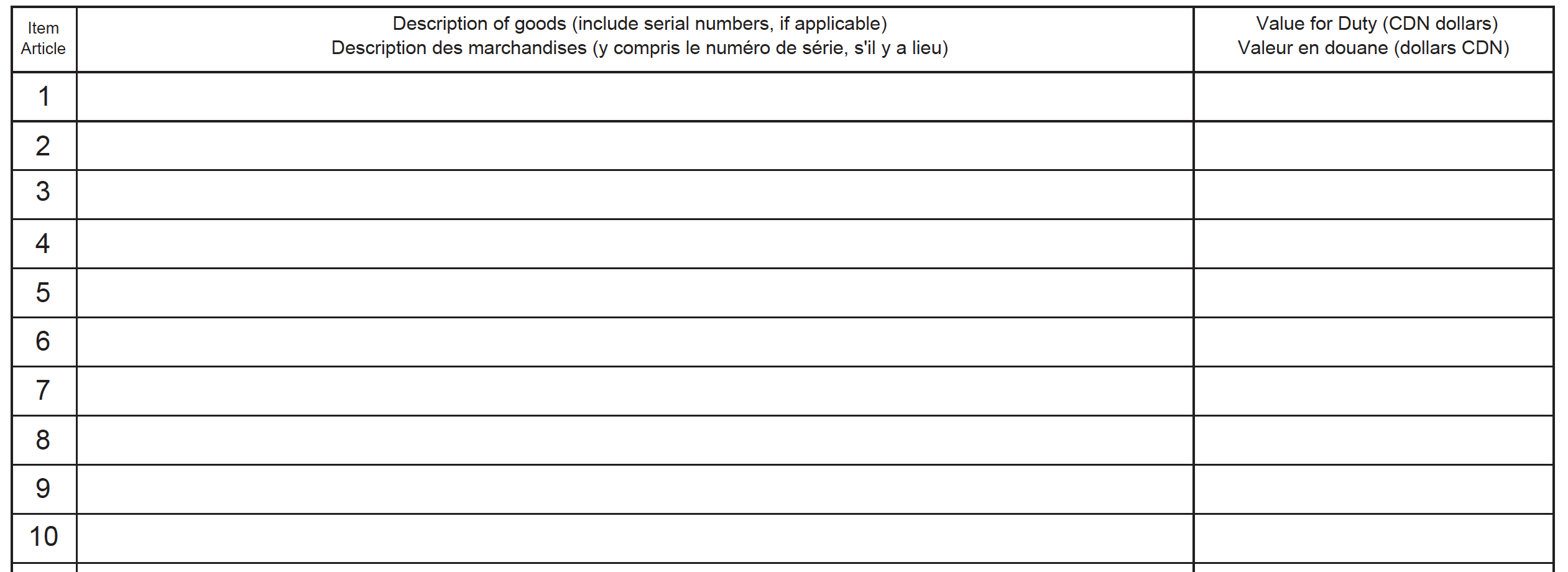

In the next section, you need to provide an itemized list of goods that you are bringing with you. You can group similar items together and outline their total value in a single row. For example, you could list “Clothes” and club all kinds of clothes under this header. Similarly, footwear, electronics, medicines, toiletries, kitchenware, personal accessories, children’s toys, etc., could be listed as separate line items.

Further, it is recommended to attach additional pages with a detailed breakdown of each category you’ve listed on the form. You can outline this in a text document or a spreadsheet and then print it out to be attached to the main form.

Tip: It’s a good idea to dedicate one page per category – it will make your list look organized and also provide the opportunity to add items (at a later point) that you may have missed initially. Also have a total amount mentioned on each page for each category and ensure this amount matches the line item on your main form.

Here’s a format you can use for the detailed breakdown in each category:

| Sr. No. | Item Description | Quantity | Value (CAD) |

|---|---|---|---|

| x | Item description | y | $abc |

Note: For electronics, where applicable, be sure to mention the serial numbers of each item.

| A note about including jewelry: Officers may ask you questions about your jewellery or precious ornaments during your customs interview. Make sure you describe each item in detail on the BSF186 (B4) form. Since jewellery is difficult to describe accurately, it is best to use the wording from your insurance policy or jeweller’s appraisal and to include photographs that have been dated and signed by a jeweller or gemologist. This makes it easier to identify the jewellery when you first enter Canada and later when you return from abroad with the jewellery. |

|---|

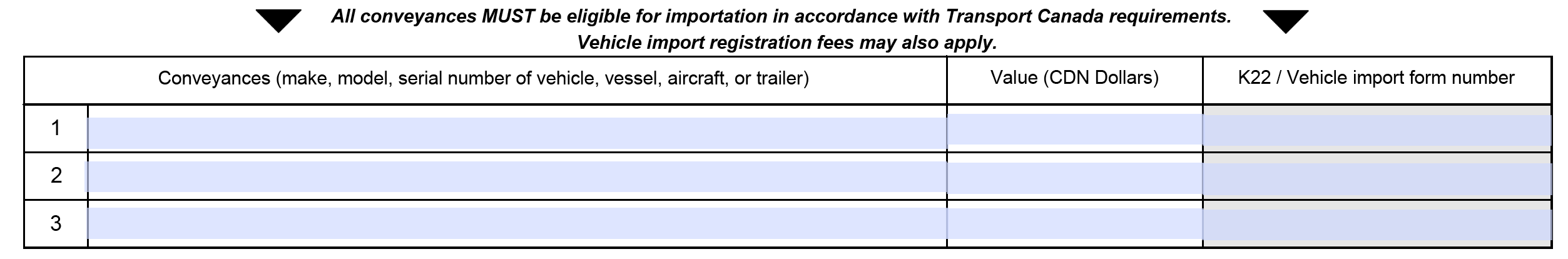

Part 3: Details of vehicles being imported to Canada

You should complete this section if you’re importing your vehicle to Canada. If you don’t have any vehicles to import, simply leave it blank or write “N/A” in the cells.

Part 4: Indicating additional goods

In this section, the last (shaded) column is to be left blank. If you have additional goods that you’ve shipped to Canada and will be arriving separately on the same day or at a later date, mark ‘Form BSF186A’ along with indicating “Yes” for “Goods to follow.” If you don’t have any goods arriving separately, choose “No” and leave the other cells blank.

Tip: Form BSF186A (or B4A) is not just meant for goods that are shipped and arriving in Canada later. You can fill this form and get it stamped by border officials even if you plan on bringing personal items (such as electronics or anything valuable) with you from your home country at a future date. This will ensure you are not charged any taxes or duty when you do bring them to Canada. Remember to have the stamped B4A form with you at the time of bringing the items.

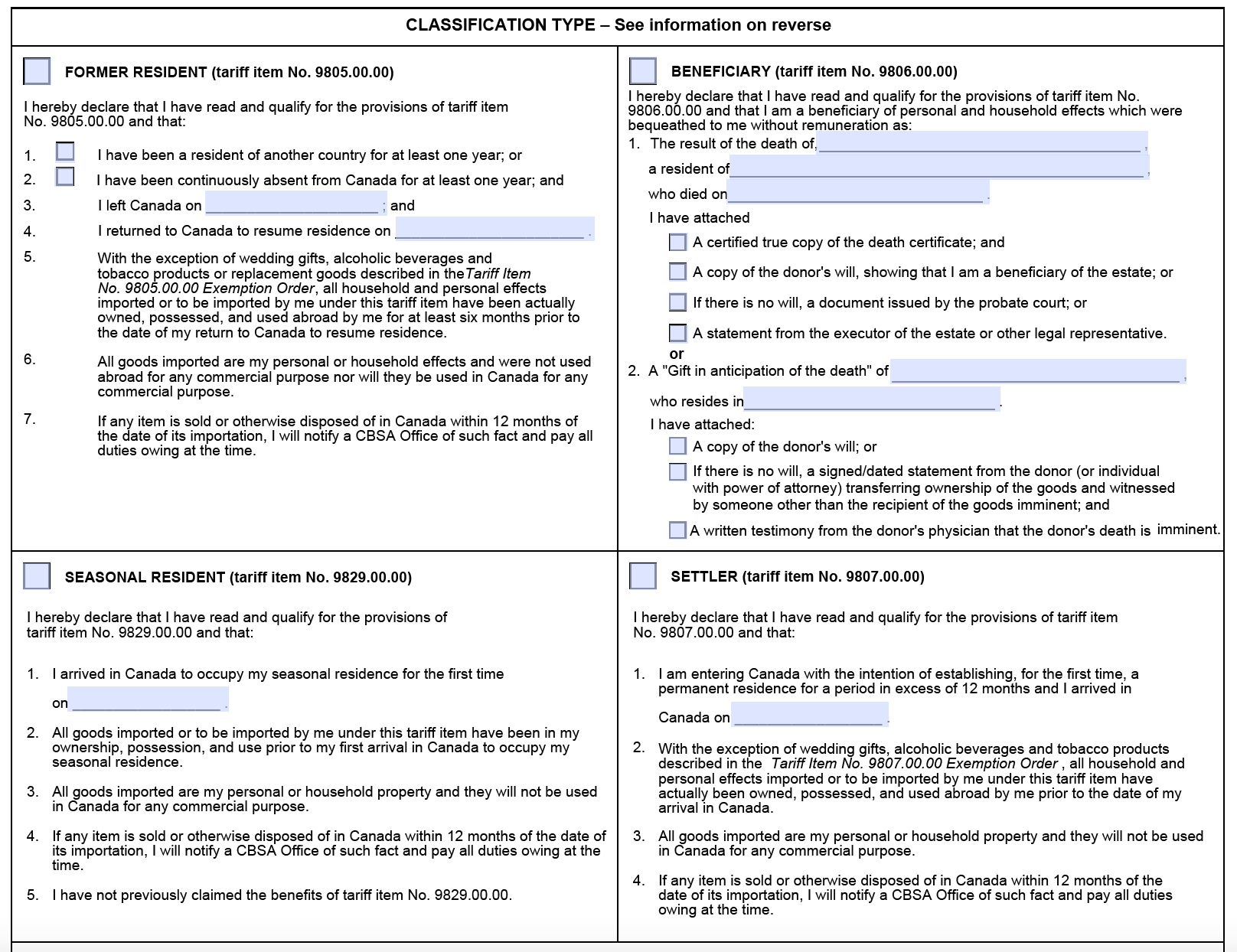

Part 5: Select the appropriate category

For the “Classification type,” most permanent residents would match the criteria outlined for “Settler” (bottom right square). However, do read the description provided for each category and choose one that applies to your unique situation. You are required to enter your landing date in the blank space provided.

Part 6: Sign off

Lastly, write the name of your city and country in the space beside “Signed at” followed by the date when you fill the form and include your signature.

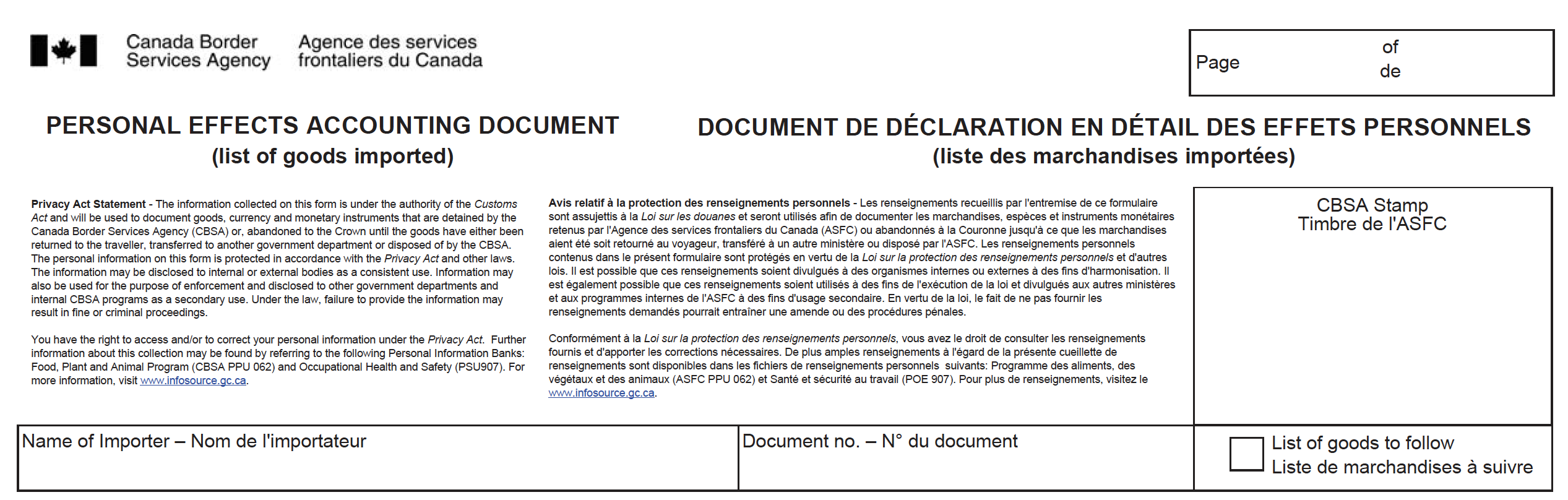

How to fill form BSF186A (also known as form B4A)

This is a relatively straightforward form compared to form B4. You can use as many pages as you need to outline the list of goods to follow.

Tip: If you plan on insuring your shipped goods, note that form B4A can also be used as a manifest for insurance purposes. In this case, it may be worthwhile to provide the replacement value of all items instead of the resale value. In the event of any damage or loss, the insurance company can compensate you appropriately.

Part 1: Personal information

Leave the columns for “Document no.” and the “CBSA stamp” blank; CBSA officials will complete it. Write your full name in the cell for “Name of Importer,” and if using multiple pages, indicate the page number in the top right column. Also, mark the column for “List of goods to follow.”

Part 2: List of goods

Be sure to outline each item along with its value in Canadian dollars. Unlike form B4, you don’t have to attach additional documents or spreadsheets with detailed breakdown here. You can group similar items in a single category (line item) and mention their collective value.

Tip: There is no penalty for not shipping an item outlined on your goods-to-follow list. Outlining it on the B4A form allows you to ship it any time in the future, in as many installments/packages/shipments as you want.

Part 3: Sign off

Once you’ve filled out all the information, sign the form and write the date. If you have multiple pages, be sure to sign and date each page.

Note: The stamped copy of the form BSF186A (or B4A) will have to be presented to the customs officer when you go to a customs depot to receive your shipped items in Canada. The officer will reconcile your list with the one they have on file and then release your goods free of taxes and/or duties.

Preparing forms B4 and B4A is a task that many newcomers struggle with as it is time-consuming and can even be confusing to some. We hope the detailed guidance provided in this article will help you prepare for your journey to Canada and avoid last-minute stress.