As a newcomer, integrating into your new financial environment in Canada will be crucial for your long-term success. Often, this means learning about new financial products, how to use them, and incorporating certain best practices into the way you manage money.

Canada is a credit-based economy, and people commonly use credit cards and other credit products. However, some newcomers to Canada are unfamiliar or uncomfortable with the concept of credit and don’t fully understand how credit cards work. In this article, we address some of the commonly asked questions about credit cards and provide valuable tips on using your Canadian credit card wisely, in a way that benefits, rather than hampers, your financial health.

In this article:

- What is a credit card?

- Why do newcomers need a credit card in Canada?

- Frequently asked questions on how credit cards work in Canada

- Types of credit card transactions in Canada

- How to apply for a credit card in Canada

- What are credit card rewards?

- Other credit card fees newcomers should know about

- How to pay your credit card bill in Canada

- What is a joint credit card?

- Are credit cards free in Canada?

- How to choose the right credit card in Canada

- Seven tips on using your Canadian credit card wisely

What is a credit card?

A credit card is a payment card issued by a bank or financial institution. It is usually a plastic or metal card with a microchip or magnetic strip. A credit card allows users to make purchases on credit. So, you can purchase items or services using money borrowed from the bank and pay it back later.

A credit card is not free money. When you get a credit card, you sign a legal contract promising to repay the funds you borrow. If you don’t pay your credit card bill in full and on time, you’ll have to pay interest on the borrowed amount in addition to the initial sum you owe.

Why do newcomers need a credit card in Canada?

Canada is a credit-based economy, and most Canadians use credit cards instead of cash or debit cards to make purchases. As a newcomer, getting a credit card is a great way to start building your credit history in Canada.

In Canada, your credit history and credit score depict your financial worthiness and help lenders assess how risky it is to give you credit. For instance, financial institutions will review your credit history before approving you for a loan (such as a car or personal loan), mortgage, or line of credit. You may also need a good credit history to rent a home or for certain financial jobs. To start building your credit history, you must get and use some credit products, such as a credit card, and start repaying the borrowed amount to the issuer.

Frequently asked questions on how credit cards work in Canada

What is your credit card billing cycle?

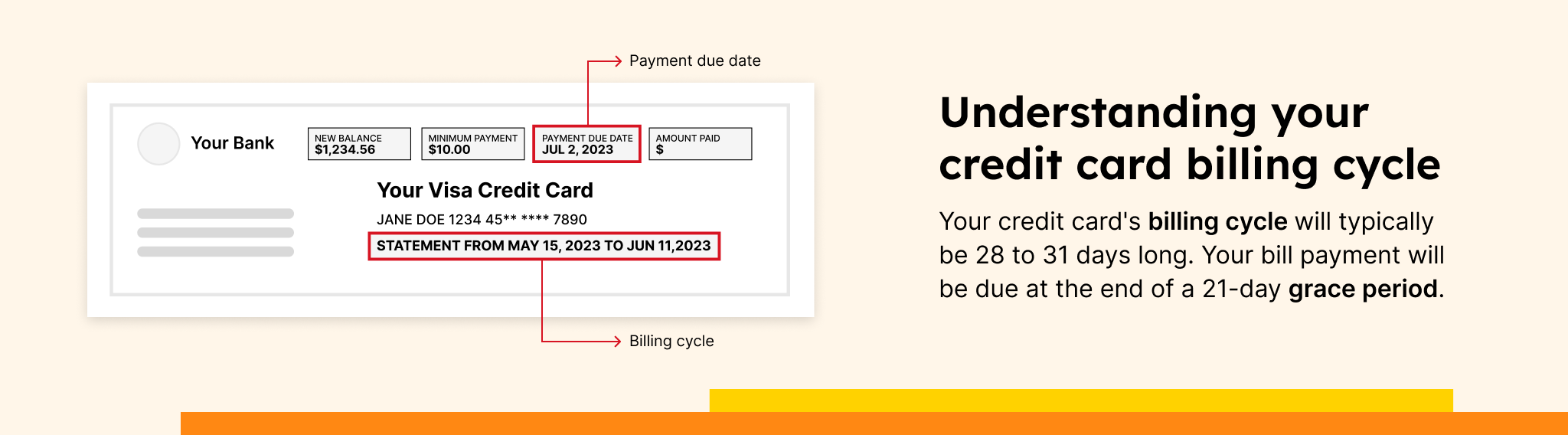

A billing cycle is the interval of time that each credit card bill covers. In Canada, your credit card’s billing cycle will typically be between 28 and 31 days long. The length is determined by the issuer of your credit card and remains fixed.

For instance, if your billing cycle is 28 days and begins on May 15, your credit card bill will include all transactions you make using the card from May 15 to June 11 (plus any previously outstanding balance).

What does credit card statement balance mean?

Your statement balance will be the sum total of all transactions you made during the billing cycle, plus any outstanding balance (with interest). This is the entire amount you owe for the billing cycle.

Let’s say, in the May 15 to June 11 billing cycle, you made three transactions on your credit card: an $800 furniture purchase, a $4.50 coffee purchase, and $120 for groceries, and you have no pending balance from the previous billing cycle. Your statement balance on June 11 will be $924.50.

What is the minimum payment for your credit card?

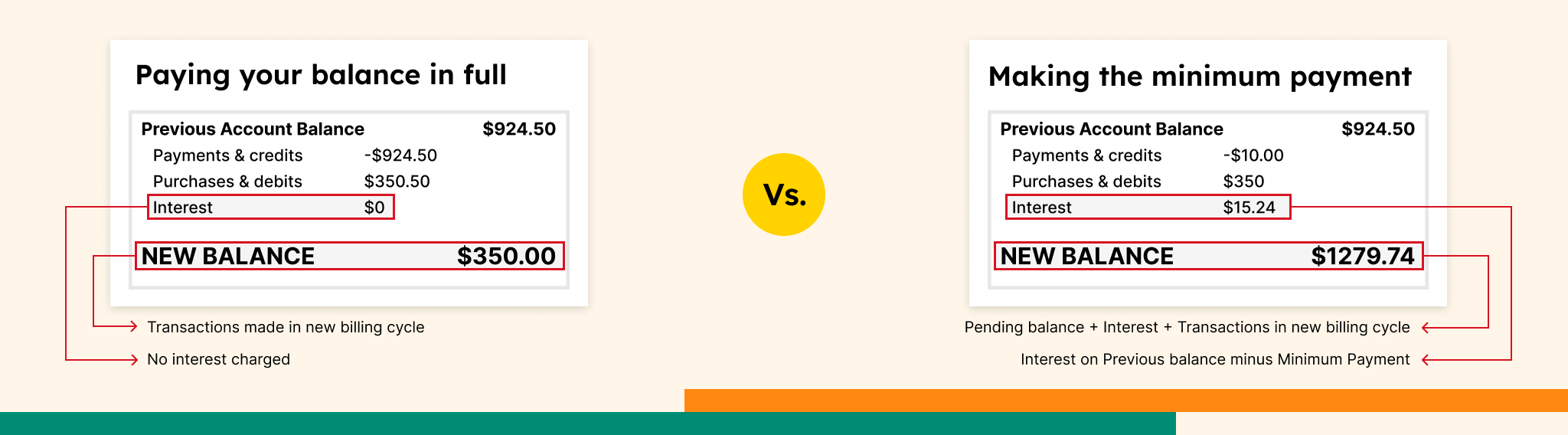

The amount listed as “minimum payment” on your credit card statement is different from your statement balance. The minimum payment is the minimum amount you must pay to avoid a late or missed payment fee, as well as a negative impact on your credit score, or an increase in your credit card interest rate.

In Canada, the minimum payment for your credit card will be either $10 or three per cent of your statement balance, whichever is higher. (In Quebec, the minimum payment is 3.5 per cent of the statement balance.)

Going back to the previous example with the $924.50 statement balance, if the minimum payment listed on your credit card bill is $10 and you only make the minimum payment required, you’ll have an outstanding balance of $914.50 plus interest in the next billing cycle (June 12 to July 9), in addition to any new transactions you make.

Interest rates on credit cards

In Canada, the interest rate on credit cards is very high. Your credit card interest rate may range between 8.99 per cent (usually only for low-interest cards) and 22.99 per cent per year. Credit card issuers may also charge different interest rates for different types of transactions, such as purchases and cash advances.

As a newcomer, paying your credit card bill in full and on time each month can help you avoid credit card debt and maintain financial stability. Interest on outstanding balances is calculated monthly and can quickly add up. Avoid spending more than you can afford to repay on your credit card, and use Arrive’s cost of living in Canada calculator to make a realistic budget. If you’ve already accumulated credit card debt, speak to your financial adviser for tips on paying it down.

What does your credit card grace period mean?

Usually, you get 21 days from the last date of your billing cycle (also called the statement date) to pay your credit card bill. These 21 days are known as the grace period. You won’t get charged interest if you pay your bill in full during this time. Similarly, if you make the minimum payment during the grace period, you won’t get charged a late payment fee.

For instance, if your billing cycle ends on June 11, you can pay your credit card bill until July 2 without accruing interest. You’ll still need to pay interest on any outstanding balance from previous billing cycles. Some financial institutions may offer a longer or shorter grace period, so be sure to read the terms and conditions for your credit card carefully.

What is a credit limit?

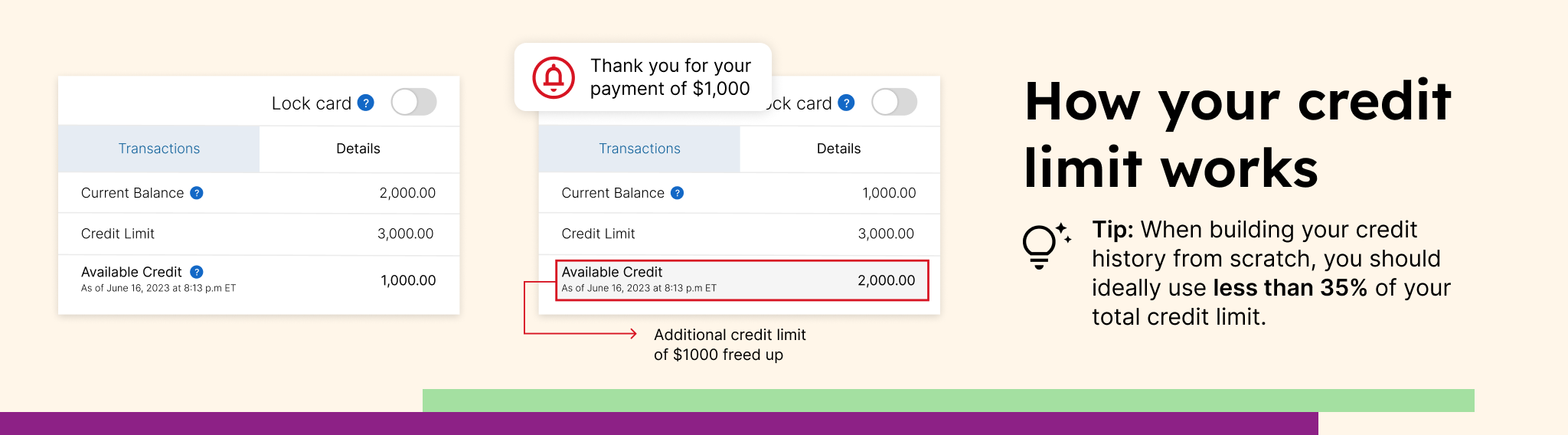

Your credit card does not give you access to unlimited borrowing. When you first receive your credit card, the issuer will inform you about your credit limit, which is the maximum amount the lender allows you to spend using your card.

As a newcomer, your first credit card in Canada may have a low credit limit of between $1,000 and $3,000. However, some banks like RBC may offer credit cards with credit limits of up to $15,000 to eligible newcomers.

As your credit history improves, you can request your financial institution to increase your credit limit. Some financial institutions may offer credit limit increases once or twice a year, depending on your credit history.

Let’s say you qualify for a newcomer credit card with a credit limit of $3,000. This means that the maximum cumulative amount you can borrow on the credit card at any given time is $3,000. However, if during a billing cycle, you’ve already used $2,000 of your credit limit and need to make an additional purchase of $2,000, you have the option of repaying all or part of the existing balance (usually listed as “current balance” in your banking app or portal) and free up your credit limit.

Although you can use your entire credit limit in a billing cycle, doing so regularly negatively impacts your credit history and score. Ideally, you should use 35 per cent or less of your credit limit each month. This keeps your credit utilization ratio low and shows lenders that you’re not overly reliant on debt and are managing your finances well.

Should I get my credit limit increased as a newcomer?

Credit limit increases may require a credit check and can cause your credit score to drop by a few points for a short time. However, since your overall credit limit will increase, your credit utilization ratio (a ratio of the credit you’ve used and the total credit available to you across all the credit products you own) will decrease, provided you continue using your credit card wisely.

Your credit utilization ratio is one of the factors that impact your credit score, and a lower credit utilization ratio will be better for your credit score in the long run. That said, it’s important to keep your spending low even as your credit limit increases and consistently use less than 35 per cent of your overall credit limit.

Types of credit card transactions in Canada

Although purchases are the most common type of credit card transaction in Canada, you can use your credit card for other types of transactions too. Plus, you should also know about add-on surcharges that sometimes get added to your purchase amounts. Different interest rates may apply to different transaction types, so here are some credit card transactions you should be familiar with:

Credit card purchases

You can use a credit card to pay for products or services at a store, online, over the phone, by mail, or through automated pre-authorized payments (such as your phone or hydro bill). As a newcomer, purchases will typically make up the bulk of your credit card transactions.

If you’re making a large purchase using your credit card, it’s worthwhile to note that some financial institutions allow you to pay for qualifying purchases in installments, at a lower interest rate than the one that generally applies to your credit card.

For instance, if you purchase a furniture item for $450, but are unable to afford to repay the full amount at the end of the billing cycle, you can split the amount into smaller installments, over a three, six, or 12-month term. In such a case, you’ll be charged a lower interest rate (typically between 4.99 per cent to 6.99 per cent) on the amount compared to your regular credit card interest rate and the installment amount will be added to your minimum payment due each month. However, if you’re able to, you should always try to pay off the amount in full at the end of the billing cycle.

Merchant surcharge on credit card transactions

In some cases, the merchant from whom you’re purchasing a product or service may apply a small surcharge (up to 2.4 per cent) over and above your purchase amount when you use a credit card (except in Quebec).

The merchant must inform you about the surcharge before processing the transaction, so you can opt for an alternate payment method if needed. Moreover, the merchant must display information about the applicable surcharge at the point of sale (in the store or online).

Cash advances using credit cards

A cash advance is when you use your credit card to get cash from an ATM (Automated Teller Machine, also called an Automated Banking Machine) or a branch. Do not confuse cash advances using your credit card with cash withdrawal from your chequing account using your debit card.

For most credit cards, the interest rate on cash advances is higher than that on purchases (sometimes as high as 30%). In addition, the interest-free grace period does not apply to cash advances, so interest starts accruing the day your billing cycle ends.

Cash advances sometimes have a per-transaction fee. Some financial institutions also consider wire transfers, money orders, or traveller’s cheques made using your credit card as cash advances.

Although cash advances may seem like a convenient way to get cash, it’s likely not going to be the cheapest. Speak to your financial advisor or consider getting other lower-interest credit products such as lines of credit or personal loans.

Credit card balance transfer

A balance transfer allows you to move outstanding balance from a credit card to a new credit card with a lower interest rate. As a result, you’ll be charged a lower interest rate on the balance as you pay it down. However, your financial institution may charge a one-time balance transfer fee (usually a percentage of the amount you’re transferring).

For instance, you have a credit card with a balance of $8,000 and you’re paying 21.99 per cent interest on it. If you were to get a credit card with a low interest of 8.99 per cent and transfer your balance to it, you can potentially save up to $86.67 per month in interest.

How to apply for a credit card in Canada

In Canada, you do not automatically get a credit card when you open a bank account. You must apply for a credit card separately and get approved for it by your bank or financial institution. You can apply for a credit card with the financial institution where you bank, or with a different bank or third-party financial institution. Here’s what newcomers need to know about applying for a credit card:

Documents needed to apply for a credit card as a newcomer

Before approving your credit card request, the financial institution will ask you for certain documents. These include:

- Proof of identity: This can be either your foreign passport or an ID issued by a Canadian government (provincial, territorial, or federal) such as your driver’s license or provincial photo ID.

- Proof of your status in Canada: You must have a valid and legal status in Canada to be eligible for a credit card. New permanent residents must show their Confirmation of Permanent Residence (CoPR) or PR card, while temporary residents must show either a work permit or study permit.

- Social Insurance Number (SIN): You’ll typically be required to provide your Social Insurance Number when you apply for a credit card or any other credit product in Canada. However, if you don’t have a SIN when you apply for your first newcomer credit card, some financial institutions may allow you to provide it later.

- Proof of address: This can be your Canadian driver’s license or any other valid document with your Canadian address on it, such as a bank statement, phone bill, or lease agreement.

- Information on any other Canadian credit cards you have: This helps financial institutions understand your current financial situation, including the total credit that has been extended to you, your balance owing, and more.

- Other documents: In some situations, you may be asked to provide additional documentation, such as proof of income (your pay stubs or employment letter may be required if you’re applying for a credit card with a minimum income requirement), or proof of savings in the form of bank statements. Since newcomers don’t have a credit history, you may sometimes be asked to provide a guarantor or security deposit to qualify for a credit card.

Factors that influence credit card approval

Applying for a credit card does not guarantee that you’ll be approved for one. Financial institutions typically want to minimize their risk, and will only offer credit products to individuals who are likely to repay.

The lender may take into account several factors to determine your ability and likelihood of repaying funds lent to you. Typically, banks will look at your credit history or credit score, however, as a newcomer, you may not have a Canadian credit history yet. Most large financial institutions understand the situation newcomers are in and might consider your income and savings (instead of your credit history), to verify that you have enough money to repay them.

If you already have a Canadian credit history, lenders will also look at your credit utilization ratio, repayment history, hard credit hits, and any history of defaults, missed, or late payments.

What are credit card rewards?

Many newcomers compare rewards while choosing a credit card. Rewards are any add-on benefits that come with your credit card, such as:

- Cash back on purchases: As the name suggests, some cards give you a small percentage of cash back when you make a purchase. Usually, you receive this cash back once a year and can use it to pay off your credit card bill or for any other purpose.

- Travel rewards: Some credit cards offer travel reward points that can be used to purchase air tickets, hotels, and for other travel-related transactions. Some travel credit cards may also award extra reward points on travel transactions or offer perks such as free travel insurance or airport lounge access.

- General rewards: Your credit card may offer reward points on purchases. Some credit cards offer higher rewards on purchases in certain categories, such as groceries or fuel. Reward points can be used for various purposes, such as paying your credit card bill, making purchases, getting gift cards, buying fuel, and more.

Other credit card fees newcomers should know about

Besides interest and merchant surcharges, here are some other credit card fees to keep in mind:

- Credit card balance insurance: This is an optional insurance you can get when you apply for a credit card. Balance protection insurance helps pay your outstanding credit card balance in case of unforeseen circumstances, such as job loss, injury, terminal illness, or death. You’ll need to pay an insurance premium to purchase this insurance.

- Late payment fees: You’ll be charged a late payment fee if you fail to pay or get delayed in paying at least the minimum balance owed on your credit card statement. To avoid late fees, be sure to pay at least the minimum balance on your credit card on or before the payment due date (before the grace period ends).

- Over-the-limit fees (or overlimit fees): Most financial institutions charge an over-the-limit fee if you go over the allocated credit limit on your credit card. As a newcomer, you should ideally use less than 35 per cent of your credit limit to improve your credit score. Before making a large purchase, don’t forget to check the remaining available balance on your credit card.

- Dishonoured payment fees: This fee is charged if your credit card bill payment fails to go through. This can happen if you don’t have sufficient funds in your bank account for your pre-authorized payment or cheque to get cleared.

- Inactive account fees: Some lenders may charge an inactivity fee if you don’t use your credit card for extended periods (usually 12 months). If you have multiple credit cards, make sure you use all of them at least occasionally. If you no longer use or plan to use some of your credit cards, contact your bank to close those accounts.

- Foreign exchange conversion charges: Separate charges may apply if you use your credit card outside Canada or on international purchases made in a different currency. In addition to the exchange rate conversion, you may need to pay a foreign exchange conversion fee (typically a percentage of the transaction amount).

- Foreign cash advance fees: If you use your credit card to withdraw cash from an ATM outside Canada, you may be charged a foreign cash advance fee that is higher than the domestic cash advance fee.

How to pay your credit card bill in Canada

It’s always a good practice to pay your bill in full within the grace period to avoid interest and debt. There are several payment options available for credit cards in Canada, including:

- Pre-authorized payment: This is a great way to automate your credit card payment so you don’t accidentally miss a payment. If you pre-authorize your payments, the full bill amount will automatically be withdrawn from the chequing account you’ve linked to your credit card on the last day of your interest-free grace period.

- Online or through your banking app: You can pay your credit card balance in full or partially, from your chequing account, through your banking app or website at any time.

- In-person at a branch: If online banking isn’t for you, you can also walk into your bank branch to pay your credit card bill in cash. If you have a chequing account in the same bank, your banking advisor can also help you make the transaction virtually.

- By cheque: You can write a cheque drawn on your chequing or savings account for a partial or full credit card payment and mail it to the address provided on your credit card statement.

- At an ATM: Some banks allow you to pay your credit card bill directly through their ATMs. You can do this by inserting your debit card into the ATM, selecting ‘credit card bill payment’, and choosing the credit card you want to pay down. You’ll be asked to enter the amount you want to pay and your debit card PIN before the transaction is processed.

- Through phone banking: Most large banks allow you to pay your credit card bill through their phone banking interface as well. If needed, you can request help from a customer support agent.

What is a joint credit card?

A joint credit card is a credit card jointly owned by two people, typically a married or common-law couple. In most cases, you can only get a joint credit card if you have a joint bank account linked to it. Both spouses (or partners) will be equally responsible for any debt accrued on the joint credit card.

If you don’t have a joint account but want to make transactions on a single credit card, you can add your spouse, common-law partner, or dependent as an authorized user and get a supplementary card (there may be an extra fee for this) made for them.

Are credit cards free in Canada?

Credit cards are not always free in Canada. In fact, most credit cards have an annual fee, but there are some no-fee cards as well. Typically, cards with an annual fee offer better rewards.

How to choose the right credit card in Canada

Although there’s no shortage of credit card options in Canada, as a newcomer, you may not qualify for a majority of these until you have some Canadian credit history. Some big banks, such as RBC, offer newcomer credit cards to recently arrived newcomers.

Even with these limited options, it isn’t always easy to figure out which credit card is ideal for you. So, before choosing a credit card, make sure you give some thought to your financial situation and priorities.

Many newcomers prefer to start with a credit card that maximizes their cash flow in the near term with features like no or low annual fees and cash back rewards. Others opt for credit cards that offer travel rewards or higher reward points on transactions they make most frequently. Read our article for tips on what to compare while selecting a credit card, so you make a decision that’s right for your situation.

If you don’t qualify for a newcomer credit card, you may be able to get a secured credit card to start building your Canadian credit history. Secured credit cards require some collateral or security deposit, and your credit limit is typically similar to the amount you’ve deposited. You can speak to an RBC Newcomer Advisor to get advice that is tailored to your specific financial situation.

Seven tips on using your Canadian credit card wisely

- Use your credit card regularly for small transactions: Whether you’re buying your daily coffee or household groceries, use your credit card to pay for day-to-day purchases. Just make sure you’re not making unnecessary purchases or spending more than you can afford on your credit card.

- Pay off your bill in full and on time: Credit cards have among the highest interest rates of all credit products, so as far as possible, avoid accumulating debt on your card. Pay your statement balance in full before the grace period ends. You can also sign up for pre-authorized payments so you never forget a due date.

- Use less than 35 per cent of your credit limit: Avoid maxing out your credit card, as that can give lenders the impression that you’re living beyond your means. Ideally, keep your spending to under 35 per cent of your credit limit to maintain a healthy credit utilization ratio and build your credit score.

- Check your credit card statement regularly: Keep an eye on your credit card bills and thoroughly check the transactions listed on it. If you come across a transaction you didn’t make or suspect that your card is being misused, flag it to your bank as soon as possible. Some banks, like RBC, allow you to “lock” your credit card through your banking app if your card is lost, stolen, or if you suspect it is being misused, to avoid unauthorized or fraudulent spend. You should also report any inaccuracies or mistakes on your credit card statement to the credit bureaus, to prevent adverse impact on your credit history.

- Steer clear of cash advances: Cash advances through your credit card have very high interest rates, and interest starts accruing as soon as your billing cycle ends. As much as possible, avoid using your credit card to withdraw cash. Instead, use your debit card to get cash if you have funds in your chequing or savings account. Alternatively, speak to your financial advisor regarding other credit products with lower interest rates, such as lines of credit or personal loans.

- When eligible, consider getting your credit limit increased: Access to a higher overall credit limit can lower your credit utilization ratio and positively impact your credit score over a longer term. Many lenders offer periodic credit limit increases to cardholders with consistent usage and repayment behaviours.

- Avoid getting too many credit cards in your first few years in Canada: Some newcomers make the mistake of getting multiple credit cards during their initial year or two in Canada, thinking it will maximize the credit available to them. However, each time you apply for a credit card, the lender will run a credit check, and having too many hard hits on your credit history in a short timespan can negatively impact your credit score.

As a newcomer, getting and using a credit card regularly is the easiest way to start building your credit history in Canada. Credit cards offer the convenience of making purchases without carrying cash, and repaying the lender at a later date. However, it’s important to remember that a credit card does not offer free money and just because you have access to a credit limit doesn’t mean you should use all of it in every billing cycle. Credit cards typically carry hefty interest, and it’s crucial that you manage your credit card usage and repayments well to avoid credit card debt.