The financial services sector in Canada comprises many roles related to the fields of accounting, insurance, and investment. In March 2020, The Conference Board of Canada released a report which highlighted Toronto as the second-largest financial centre in North America and the seventh-largest globally, in employment.

Many newcomers to Canada have a background in finance and intend to continue working in their field after moving. However, since most finance-related roles are regulated occupations, newcomers sometimes find it challenging to navigate the job market. In this article, we will help you understand how to analyze the scope for finance occupations in Canada and make a successful transition to the Canadian job market.

| Note: The National Occupational Classification (NOC) is Canada’s national system for describing occupations. The NOC code is a five-digit number that plays an important part in your immigration application. (Till November 16, 2022, NOC codes included four digits.) The NOC groups jobs based on the type of job duties and the skills, education, and experience required for the work a person does. You can find your NOC code on the Government of Canada website. |

|---|

Here are some of the NOCs that broadly cover all the roles in the field of finance, accounting, insurance, and investment:

| NOC Code | NOC Code Name | Example Titles |

|---|---|---|

| 10010 (previously 0111) | Financial managers | Controller – financial services, Director – financial services, Director of accounting, Finance director, Financial administrator, Financial control manager, Financial planning and analysis manager, Internal audit services manager, Treasurer, Corporate risk department manager, Pension plans administrator, Pension services manager |

| 10020 (previously 0121) | Insurance, real estate, and financial brokerage managers | Bond sales manager, Brokerage manager – investments, Commodities trading manager, Financial brokerage manager, Insurance claims service manager, Insurance manager, Investment manager – financial brokerage, Mortgage broker manager, Real estate service manager, Securities sales director, Trading floor manager, Real estate developer |

| 10021 (previously 0122) | Banking, credit, and other investment managers | Assistant operations manager – banking, credit and investment, Bank manager, Banking operations manager, Collection centre manager, Commercial banking manager, Corporate banking centre manager, Corporate services manager – banking, credit and investment, Credit card centre manager, Credit card company operations manager, Credit manager, Credit union manager, Mortgage and consumer credit manager, Personal services manager – banking, credit and investment, Regional collection manager, Trust company manager |

| 11100 (previously 1111) | Financial auditors and accountants | Accountant, Chief accountant, Financial auditor, Income tax expert, Industrial accountant, Internal auditor |

| 11101 (previously 1112) | Financial and investment analysts | Chartered financial analyst, Financial analyst, Financial services research associate, Investment analyst, Money market analyst, Portfolio manager |

| 11103 (previously 1113) | Securities agents, investment dealers, and brokers | Bond dealer, Broker, Commodity broker, Discount broker, Floor trader – commodity exchange, Foreign exchange trader, Investment dealer, Mutual fund broker, Mutual fund sales representative, Registered investment representative, Registered representatives supervisor, Securities agent, Securities sales agent, Securities trader, Stockbroker |

| 11102 (previously 1114) | Financial advisors | Account manager, Financial advisor, Financial consultant, Financial planner, Financial security advisor, Personal finance advisor, Personal investment advisor |

| 11109 (previously 1114) | Other financial officers | Credit adjudicator, Credit unions examiner, Estate and trust administrator, Financial institutions inspector, Financial investigator, Financial underwriter, Mortgage broker, Trust officer |

| 12011 (previously 1212) | Supervisors, finance, and insurance office workers | Accounts payable supervisor, Accounts receivable supervisor, Bank clerks supervisor, Billing supervisor, Bookkeeping supervisor, Claims adjusters supervisor, Collection supervisor, Credit supervisor, Payroll supervisor, Supervisor of accounting |

| 12200 (previously 1311) | Accounting technicians and bookkeepers | Accounting bookkeeper, Accounting technician, Bookkeeper, Finance technician |

| 12201 (previously 1312) | Insurance adjusters and claims examiners | Adjuster, Claims examiner, Claims representative, Insurance adjuster, Production examiner |

| 12202 (previously 1313) | Insurance underwriters | Group underwriter, Insurance underwriter, Liability underwriter, Property underwriter, Casualty insurance products analyst-designer, Insurance rating analyst |

| 12203 (previously 1314) | Assessors, business valuators and appraisers | Accredited appraiser, Business valuator, Chartered business valuator (CBV), Property assessor, Property valuator, Real estate appraiser, Real estate analyst |

| 13200 (previously 1315) | Customs, ship and other brokers | Cargo broker, Chartered shipbroker, Customs broker, Gas broker, Licensed customs broker, Shipbroker, Ship line agent |

| 14200 (previously 1431) | Accounting and related clerks | Accounting clerk, Accounts payable clerk, Accounts receivable clerk, Audit clerk, Billing clerk, Budget clerk, Costing clerk, Deposit clerk, Finance clerk, Freight-rate clerk, Income tax return preparer, Invoice clerk, Ledger clerk, Tax clerk, Wharf clerk |

| 13102 (previously 1432) | Payroll administrators | Benefits officer – payroll administration, Pay advisor, Pay and benefits administrator, Pay and benefits clerk, Pay clerk, Payroll clerk, Payroll officer, Salary administration officer |

| 14201 (previously 1434) | Banking, insurance and other financial clerks | Actuarial clerk, Bank clerk, Credit clerk, Dental claims clerk, Dividend calculation clerk, Insurance clerk – financial sector, Insurance rater, Ledger control clerk, Loan clerk – financial sector, Mortgage clerk, Premium rater – insurance, Real estate clerk, Securities clerk – financial sector |

| 14202 (previously 1435) | Collectors | Bill collector, Collection clerk, Collection officer (except taxation), Collections investigation officer, Collector, Credit and collection clerk, Locator – collection, Skip tracer – collection |

Figuring out your NOC code makes the process of analyzing the job market easier.

Tip: For the purpose of analysis, you don’t have to be restricted to one single code; you can look at multiple codes that require your skills and decide which one might be better suited to your situation.

| Navigating the Canadian job market can be overwhelming. Arrive guides on Finding Your Career in Canada and the Canadian Job Market are a quick and concise overview that explains all the need-to-know information and action items you can take to prepare yourself for finding and landing a job opportunity in Canada. |

What is the demand for finance, accounting, insurance, and investment roles in Canada?

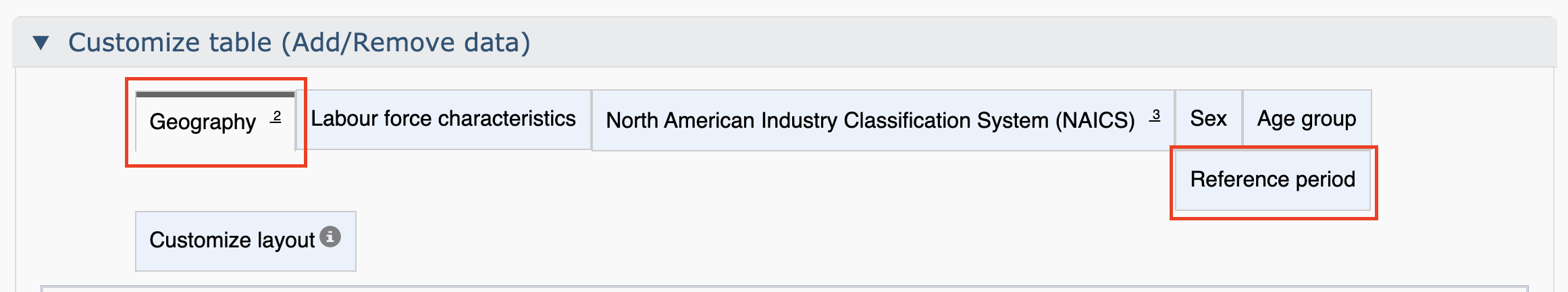

To get an idea of the big picture, Statistics Canada (StatCan) is a good resource. They publish monthly and annual employment trends for various industries. This is a good starting point to get an idea of the employment trends for professions related to finance, accounting, insurance, and investment; any increase or growth is a good sign.

The monthly and annual employment trends data on Statistics Canada is grouped by industries. As per the North American Industry Classification System (NAICS), most financial and insurance roles are categorized under code 52 – Finance and Insurance, while some others like accounting, taxation, and bookkeeping are categorized under code 54 – Professional, Scientific, and Technical Services. Therefore, when you look at employment trends in Statistics Canada, you will have to look up both of these categories.

Statistics Canada also allows you to filter the numbers by province – this is a good way to identify provinces that have the maximum demand for your skills and know the probability of finding a job in your field. For instance, in 2021, among all provinces, Ontario had maximum employment for NAICS codes 52 and 54, followed by Quebec.

If you would like to gain a better understanding of the overall job market trends, you can look at the following two sites:

- Statistics Canada publishes monthly reports which can be found by searching for the Labour Force Survey. A general Google search with the keywords (Labour Force Survey + latest month and year) will take you directly to the relevant webpage. You can have a look at the reports of September 2022 and August 2022 to get an idea. Note that these are overall trends and not specific to the financial or accounting sector. However, they will have subsections for noteworthy NAICS categories for that month.

- Explore the Finance, Accounting, Insurance, and Investment job market in various provinces by reading a comprehensive report published by Canada’s Job Bank. Once you’re on the webpage, choose a province and then scroll down to sectoral profiles. Select either Finance and Insurance or Professional, Technical, and Scientific Services for deeper insight into the sector.

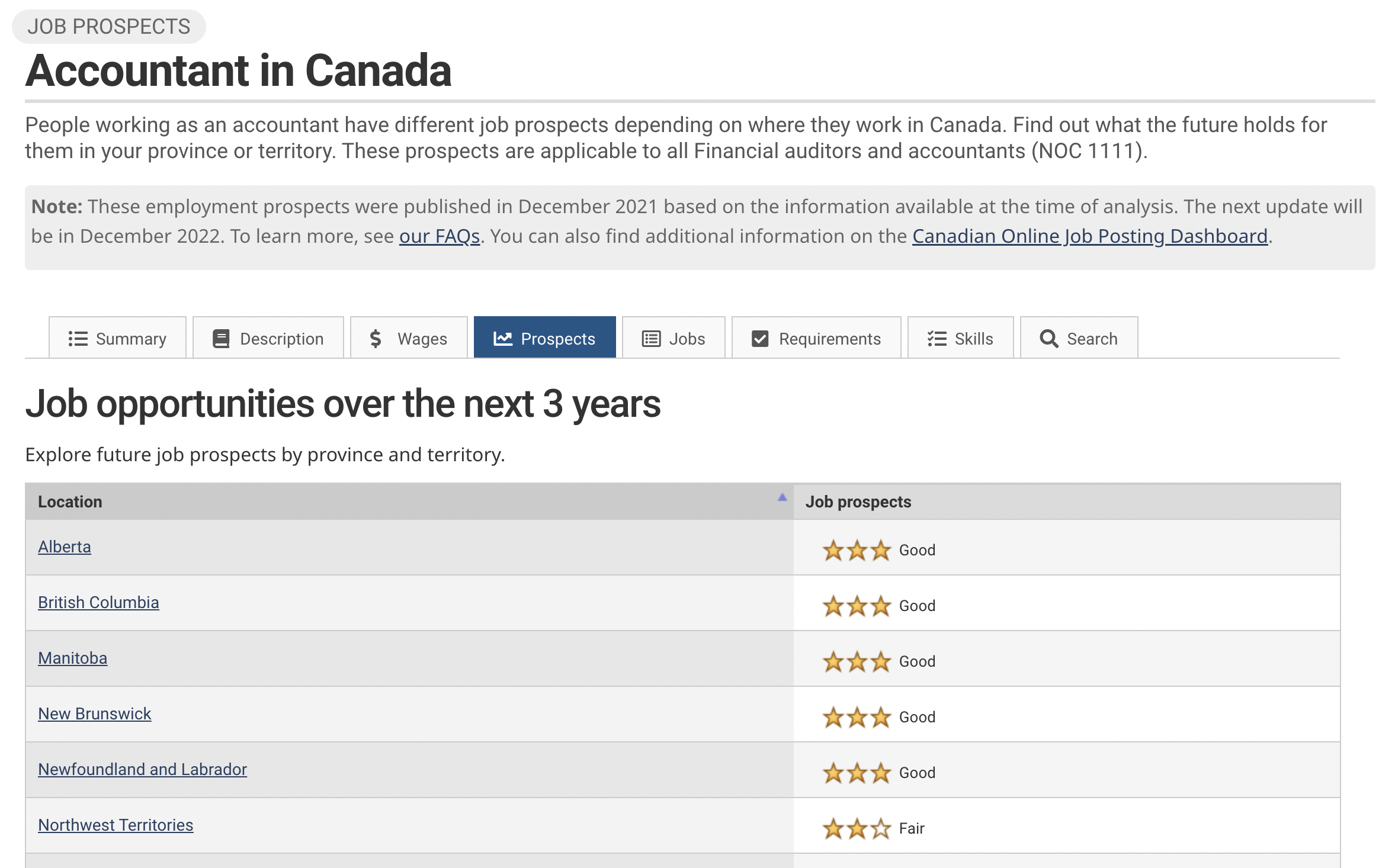

Tip: For a quick overview, type in your NOC code or job title on the Occupation Trends page and search. Here’s a summary of the role of an Accountant (NOC 11100) in Canada. The main summary page will provide various details such as educational and skill requirements for the role, average wages, and the number of jobs available. Clicking on the Prospects tab will show you a provincial breakdown of job prospects.

This exercise will help you set realistic expectations for being able to find a job in your field in a specific province or region.

How to narrow your research and identify a city where finance, accounting, insurance or investment skills are in-demand

Once you decide on a province where you would like to work, as a next step, you can start looking at specific cities that might offer more opportunities to find a job in your desired role. For this, Canada’s Job Bank website is an excellent resource.

On the Prospects page, when you click on a specific province, it will provide a further split by region. For instance, you can view the opportunities for an Accountant in Ontario on the same site.

After narrowing down the region, you can go back to the main Occupation Trends page, type in your NOC and region or city to get a similar detailed report.

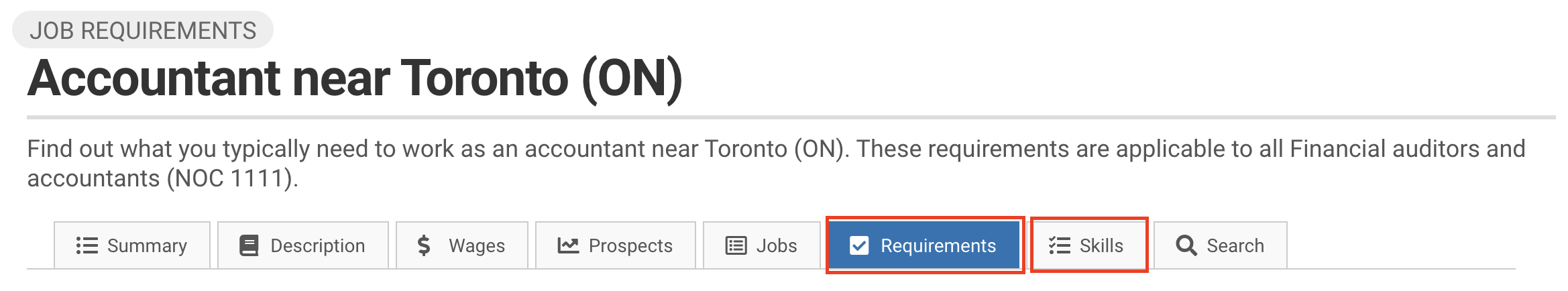

How to identify relevant finance, accounting, insurance, or investment certifications or licenses that may be required for your role

Different provinces and territories may have different requirements for professional licenses and certifications. Identifying if you would need to obtain a license or certification can help you get a headstart in preparing for your employment in Canada.

| Note: All occupations in Canada are classified into regulated and non-regulated occupations, which differ by province. You can find out if your profession is regulated by typing in your NOC code and province/territory on the Canadian Information Centre for International Credentials (CICIC) website. Regulated occupations typically require you to have a license and/or a certification to be able to work in the field. |

|---|

Many roles in the field of finance, accounting, taxation, insurance, and investment are regulated occupations in Canada, so you may have to obtain a certification and/or a license to be able to work in the field.

Considering the instance of an accountant (as mentioned above):

- The same page on the Job Bank website will provide a list of skills and requirements (such as licenses and certifications) to be able to work in the field.

- For a Chartered Professional Accountant working in Ontario, obtaining a certification from Chartered Professional Accountants (CPA) of Ontario is mandatory.

- If you’re a Public Accountant, then the CPA certification is not mandatory, however, you can opt to get certified by the Public Accountants Council for the Province of Ontario, which may improve your job prospects.

For an accountant, apart from the certifications requirements to be able to work in Toronto, the following is usually required:

- A university degree and;

- Completion of a professional training program approved by a provincial institute of chartered accountants (in this case, CPA Ontario) and;

- Either two years or 30 months of on-the-job training and membership in a provincial Institute of Chartered Accountants (in this case, CPA Ontario) upon successful completion of the Uniform Evaluation (UFE).

Navigating salary expectations for finance, accounting, insurance, or investment roles in Canada

Setting salary expectations is another key area of importance for newcomers. There are many sites to conduct salary research: The Job Bank website, Glassdoor, and reports published by recruitment firms such as Hays and Randstad are some of them. Your salary would vary greatly depending on the city you’re based in and your work experience.

Each of these sources will let you filter your profession by experience level and region and city so that you can get a very real sense of salary expectations. It is a good idea to compare numbers from different sites to get a good ballpark figure.

For instance, an accountant working in Toronto can expect to earn approximately $65,000 to $93,000 on average, depending on their level of experience.

How to find a finance, accounting, insurance, or investment-related job in Canada

1. Online and offline methods

In addition to Canada’s Job Bank website and other online job search portals such as LinkedIn Jobs, Indeed, Monster, Workopolis, CareerBuilder, SimplyHired, etc., you can sign up for industry events and register with specialized recruitment or staffing agencies who can help market your resume to potential employers. Industry events in your city or neighbourhood can be found on sites like Eventbrite.

2. Networking

Networking is crucial to finding employment in Canada. LinkedIn is a good starting point for you to build your network. See the top 10 tips to optimize your LinkedIn profile.

You can use the following Arrive resources to help be better prepared for your job search:

Arrive is with you every step of the way. |

|---|

3. Get relevant certifications

Depending on your role, a certification might be mandatory (as outlined above) for you to be able to work in your field. Getting certified in Canada will improve your employment prospects and strengthen your resume. Read our article on how to move to Canada as an accountant for more information.

4. Build a strong resume

The most important tool in your quest to find your dream job is your resume. Ensure that your resume is always up-to-date and aligned with the Canadian style of formatting. Moreover, you’ll need to customize your resume for each job, including relevant keywords from the job description.

What does the hiring process look like for finance, accounting, insurance, or investment-related roles in Canada?

The hiring process for finance-related roles is usually split into multiple rounds:

- Screening: This is usually a telephonic round where the interviewer will discuss basics such as role expectations, compensation, and chat about your experience.

- Knowledge testing: If the interviewer determines that you are a good fit for the role, the initial round is followed up with two or three more rounds of conversations primarily focused on evaluating your domain knowledge and cultural fit. These rounds may include one or more tests.

- Final round: The hiring manager or recruiter will usually contact you to extend a verbal offer. The offer letter is usually sent via email following the phone call.

On average, the entire interview process can take between two to six weeks, depending on the urgency of the position to be filled and the availability and scheduling of everyone involved in the process.

Looking for more job market analyses? Read our job market analysis on Information Technology (IT) roles in Canada.

A report published by the government of Canada indicated that “the country has a strong, globally competitive financial sector that has proven to be stable, resilient and well respected. In addition to the services it provides, the financial sector is a source of economic strength and employment.” The sector provides plenty of opportunities for newcomers to acquire essential skills and accelerate their careers.

Conducting thorough research prior to your move will help you identify relevant job opportunities that are best suited to your unique position and ensure a smoother transition for you and your family to Canada.